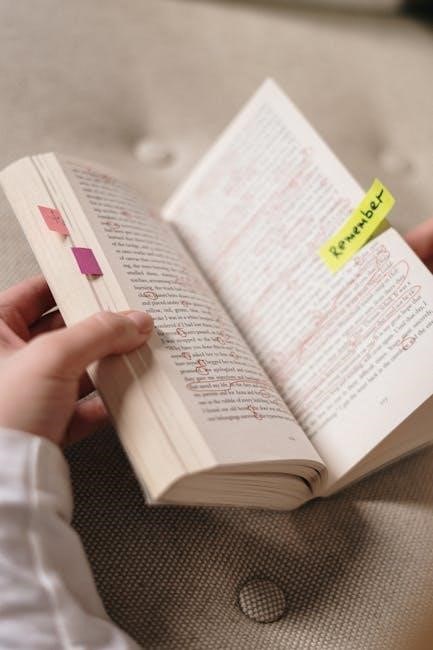

Investing note-taking is essential for capturing key insights, organizing information, and making informed decisions․ It ensures clarity and structure, aiding in strategic financial planning and portfolio management effectively․

1․1 Understanding the Importance of Note-Taking in Investing

Note-taking in investing is crucial for capturing essential information, organizing data, and enhancing decision-making․ It serves as a valuable reference for reviewing and reinforcing key concepts, helping investors track progress and maintain clarity․ By documenting insights, risks, and strategies, note-taking bridges the gap between information and application, ensuring better management of investments and fostering long-term financial success․ It also aids in identifying patterns and trends, making it a cornerstone of effective investment planning and portfolio management․

Benefits of Effective Note-Taking in Finance

Effective note-taking in finance enhances memory retention, streamlines decision-making, and improves organizational skills; It reduces errors, ensures clarity, and provides a structured approach to managing financial information efficiently․

2․1 Enhancing Memory Retention and Comprehension

Effective note-taking significantly improves memory retention and comprehension by actively engaging the brain․ By summarizing key points and organizing information, investors can better recall financial concepts and strategies․ This structured approach ensures that complex ideas are broken down into manageable parts, facilitating deeper understanding and application․ Regular review of notes strengthens long-term retention, making it easier to reference critical information during decision-making processes․

2․2 Streamlining Decision-Making Processes

Effective note-taking plays a crucial role in streamlining decision-making by providing clarity and quick access to critical information․ Organized notes allow investors to review key data efficiently, reducing the time spent searching for details․ This structured approach ensures that financial decisions are based on comprehensive analysis rather than guesswork, enabling investors to act swiftly and confidently․ Clear notes also help identify patterns and trends, further supporting informed choices in dynamic markets․

Key Fundamentals of Investing to Include in Notes

Key investing fundamentals to include in notes are risk tolerance, investment goals, diversification strategies, portfolio management techniques, and understanding financial instruments and market analysis․

3․1 Risk Tolerance and Investment Goals

Risk tolerance and investment goals are foundational elements in investing․ Risk tolerance assesses an individual’s comfort with market volatility, while investment goals define objectives like capital growth or income generation․ Understanding these ensures alignment with financial strategies, balancing risk and return․ Documenting these factors helps investors stay focused, avoid impulsive decisions, and monitor progress toward their targets, ensuring a tailored and disciplined approach to wealth management․

3․2 Diversification and Portfolio Management

Diversification spreads investments across asset classes to minimize risk, while portfolio management ensures alignment with financial goals․ Note-taking helps track asset allocation, monitor performance, and document adjustments․ Regular reviews allow investors to rebalance portfolios, ensuring optimal risk-return alignment․ By recording diversification strategies and portfolio changes, investors maintain clarity and control, fostering informed decisions and long-term financial success․

3․3 Financial Instruments and Market Analysis

Financial instruments, such as stocks, bonds, and ETFs, form the backbone of investing․ Note-taking helps document their characteristics, risks, and market trends․ By recording market analysis, investors track economic indicators, company performance, and sector dynamics․ This process enables better understanding of instrument behaviors and informs strategic decisions, ensuring alignment with investment objectives and risk tolerance․ Detailed notes on market trends and instrument specifics empower investors to make data-driven choices and adapt to evolving financial landscapes effectively․

Effective Note-Taking Methods for Investors

Investors can use methods like the Cornell system, outlining, and mind mapping to organize information․ These techniques enhance clarity, structure, and quick access to critical financial data efficiently․

4․1 The Cornell Note-Taking Method

The Cornell method uses a structured approach with two columns and a summary row․ The cue column on the left captures key terms or questions, while the note column on the right details explanations․ This system enhances organization, review, and retention of financial data․ Investors benefit from clear, concise notes that facilitate quick access to critical information, making it ideal for analyzing market trends and investment strategies․ Its structured format aids in identifying patterns and relationships, improving decision-making processes․

4․2 Outline Method for Structured Learning

The outline method organizes information hierarchically, using bullet points and headings to structure notes․ It mirrors the lecturer’s outline, with major concepts as headings and subpoints below․ This approach is ideal for capturing main ideas and study questions․ However, it can become cluttered if too detailed․ Investors often use this method to track financial data, ensuring notes remain clear and accessible for future reference․ It’s a foundational technique that supports structured learning and decision-making in investing․

4․3 Mind Mapping for Visual Learners

Mind mapping is a visual note-taking technique that uses diagrams to connect ideas․ It starts with a central concept, branching out to related topics․ This method enhances creativity and helps investors visualize relationships between financial instruments, market trends, and portfolio strategies․ Visual learners find it effective for organizing complex information and recalling key details․ By creating a map of ideas, investors can quickly identify patterns and make informed decisions, making it a powerful tool for structured and intuitive learning․

Tips for Taking Notes During Online Lectures

Schedule consistent times for lectures, review past notes, and take breaks to stay alert․ Listen for key cues like numbers or tone changes to identify important points․

5․1 Scheduling and Preparation

Effective note-taking during online lectures starts with proper scheduling and preparation․ Set a consistent time to watch pre-recorded lectures and review previous notes beforehand․ Create a structured environment free from distractions to enhance focus․ Use digital calendars to organize lecture schedules and set reminders․ Prioritize reviewing key concepts from earlier sessions to build a strong foundation․ Having a clear plan ensures you approach each lecture with purpose, making note-taking more efficient and targeted toward your learning goals․

5․2 Identifying Key Information Cues

Identifying key information cues during online lectures is crucial for effective note-taking․ Pay attention to numerical data, changes in tone or volume, and phrases like “The first step․․․” or “Three main branches․․․”․ These signals indicate important concepts․ Use these cues to prioritize information, ensuring your notes capture essential details without unnecessary content․ This selective approach enhances comprehension and helps you focus on what matters most for your investment learning and decision-making processes․

Organizing Digital Notes for Better Accessibility

Organizing digital notes involves using tools and creating structured filing systems to enhance accessibility․ This ensures efficient retrieval of information, supporting informed investment decisions and streamlined learning processes․

6․1 Utilizing Digital Tools and Apps

Digital tools and apps like Evernote, OneNote, and Simplenote simplify note organization․ These platforms offer features such as tagging, searching, and cross-device syncing, enabling easy access to investment notes․ Apps like Bear and Notion provide advanced structuring options, allowing users to create detailed databases and folders․ Utilizing these tools enhances productivity by streamlining note retrieval, ensuring that critical investment insights are always accessible․ Regular backups and cloud storage further protect valuable information, making digital tools indispensable for modern investors․

6․2 Creating a Filing System for Notes

A well-organized filing system ensures easy access to investment notes․ Use clear folders and tags to categorize notes by topics, such as risk tolerance or diversification․ Maintain consistency in naming conventions and regularly review notes to update or archive outdated information․ This structured approach prevents data loss and saves time, allowing investors to focus on analyzing and applying their notes effectively․ A logical filing system enhances productivity and supports informed decision-making․

Common Mistakes to Avoid in Note-Taking

Overloading notes with irrelevant information and neglecting regular reviews are common pitfalls․ Ensure clarity and conciseness to maintain note effectiveness and avoid information overwhelm, enhancing decision-making․

7․1 Overloading Notes with Irrelevant Information

Overloading notes with unnecessary details can hinder their effectiveness․ While capturing data, focus on key concepts, such as risk tolerance, diversification, and market trends, rather than recording everything verbatim․ Irrelevant information burdens notes, making them harder to review and apply․ To avoid this, prioritize clarity and brevity, ensuring each point directly ties to investment goals or strategies․ This streamlined approach enhances accessibility and supports better decision-making in real-world investing scenarios, keeping notes concise and actionable․

7․2 Lack of Review and Follow-Up

Failing to review and follow up on notes can lead to missed investment opportunities and poor decisions․ Over time, notes become less useful if not revisited, as key insights fade from memory․ Establishing a routine for reviewing and organizing notes ensures that information remains accessible and actionable․ Without regular follow-up, even the most detailed notes risk becoming obsolete, undermining their potential to inform strategic decisions and drive successful investing outcomes․

Applying Notes to Real-World Investing Scenarios

Effective notes enable investors to analyze market trends, evaluate risks, and make informed decisions․ They serve as a practical tool for translating knowledge into actionable investment strategies consistently․

8․1 Using Notes for Market Research

Notes play a crucial role in market research by helping investors organize and analyze vast amounts of data․ They enable the identification of trends, patterns, and key metrics, which are essential for informed decision-making․ By documenting insights from financial reports, news articles, and expert opinions, investors can compile a comprehensive view of market dynamics․ This structured approach allows for better tracking of investments, validation of ideas, and staying updated on industry developments, ultimately leading to more strategic and confident investment choices․

8․2 Informing Investment Decisions with Note Insights

Effective note-taking directly enhances investment decisions by providing clear, accessible insights․ Organized notes allow investors to recall key data, trends, and expert opinions quickly․ By referencing detailed records, investors can assess risks, identify opportunities, and align choices with their financial goals․ Notes also facilitate the evaluation of past decisions, enabling lessons to be learned and strategies refined․ This systematic approach ensures that investment choices are informed, rational, and aligned with long-term objectives, ultimately fostering confidence and success in the financial markets․

Note-taking is vital for successful investing, offering clarity, confidence, and continuity․ By bridging planning and execution, it ensures informed decisions and fosters continuous learning and strategic financial growth․

9․1 Summarizing the Role of Note-Taking in Successful Investing

Note-taking is a foundational skill for successful investing, enabling the capture of key insights, trends, and data․ It supports informed decision-making by organizing complex information and linking planning to execution․ Effective notes enhance memory retention, streamline analysis, and provide a clear framework for portfolio management․ By documenting goals, risks, and market trends, note-taking fosters a disciplined approach, ensuring alignment with investment objectives and promoting continuous learning․ Ultimately, it bridges knowledge gaps, builds confidence, and drives strategic financial growth․